Q3 2024 Update for Stockholders

Q3 2024 Update for Stockholders

October 30, 2024

Dear BREIT Stockholder,

We are proud of BREIT’s performance and positioning as the real estate market enters its recovery phase. BREIT has delivered a +2.4% Class I return YTD and a +9.8% Class I annualized net return since inception, ~50% higher than publicly traded REITs and ~3x the return of private real estate.1,2 While our third quarter performance was flat, BREIT’s net return would have been +2.3% before the impact of our fixed rate debt hedges, which is reflective of strengthening real estate values.

We believe BREIT’s outperformance since inception is grounded in Blackstone’s proven track record of leveraging our proprietary insights to spot trends ahead of the curve. At Blackstone, we began investing in data centers before the rise of AI, started acquiring warehouses in 2010 in the early days of the shift to e-commerce, and rotated out of office before the drop off in secular demand. Today, these same proprietary insights which have powered our performance are telling us to get off the sidelines and that now is the time for private real estate.

We believe BREIT is well-positioned to take advantage of the real estate recovery

Why private real estate now? After two challenging years, private real estate values have bottomed in our key sectors and have increased every quarter since the end of 2023.4 The public real estate market has also rallied sharply, reflecting broad-based improving sentiment. History tells us that real estate has outperformed at this point in prior cycles: in multi-year recovery periods following a downturn, private real estate has delivered approximately double the return of all other periods.5 Over the last few years, money market funds or cash have been popular with investors, but these may be increasingly unappealing following the 50 basis point rate cut in September and the prospect of additional cuts by year end. Real estate has a strong track record in environments like this: in periods following 100 basis point declines in the 10-Year U.S. Treasury rate, real estate generated 4x the performance of investment grade bonds.6 Our stockholders also benefit from the fact that real estate can offer long-term compounding with healthy absolute returns backed by hard assets, and compelling, tax-advantaged distributions. We think real estate continues to be an important part of portfolio construction especially in this environment and that BREIT, as a vehicle designed to build long-term wealth, is well-positioned to continue to deliver strong performance as the real estate recovery unfolds.

What’s behind the real estate recovery? First, debt markets are improving as financing is becoming cheaper and more available, with a ~40% decline in borrowing costs and a ~4x increase in CMBS issuance year over year.7 This has jumpstarted transaction activity, with U.S. transaction volume up 23% quarter over quarter.8 Blackstone Real Estate, including BREIT, has invested or committed~$30B of equity in the last twelve months globally.9 New construction is also declining dramatically from elevated levels. Starts in BREIT’s key sectors are down ~40-75%+ from recent peaks, near 10-year lows, which should set the foundation for strong supply-demand fundamentals and accelerating growth as we look ahead.10 Finally, improving sentiment is an additional tailwind, which we have seen reflected in BREIT’s fundraising, with repurchase requests down more than 90% from their 2023 peak and subscriptions trending positively.11

How will this impact real estate performance? Historically, lower interest rates have led to lower cap rates (higher valuation multiples) and the impact of this on private real estate can be quite meaningful. They are not directly correlated, and it can take a few quarters to see the impact of lower rates in real estate values as transactions often take 90+ days to close. That said, by way of illustration, just a 10-basis point hypothetical decline in cap rates (increase in valuation multiples) alone could result in a 4% increase in real estate returns.12

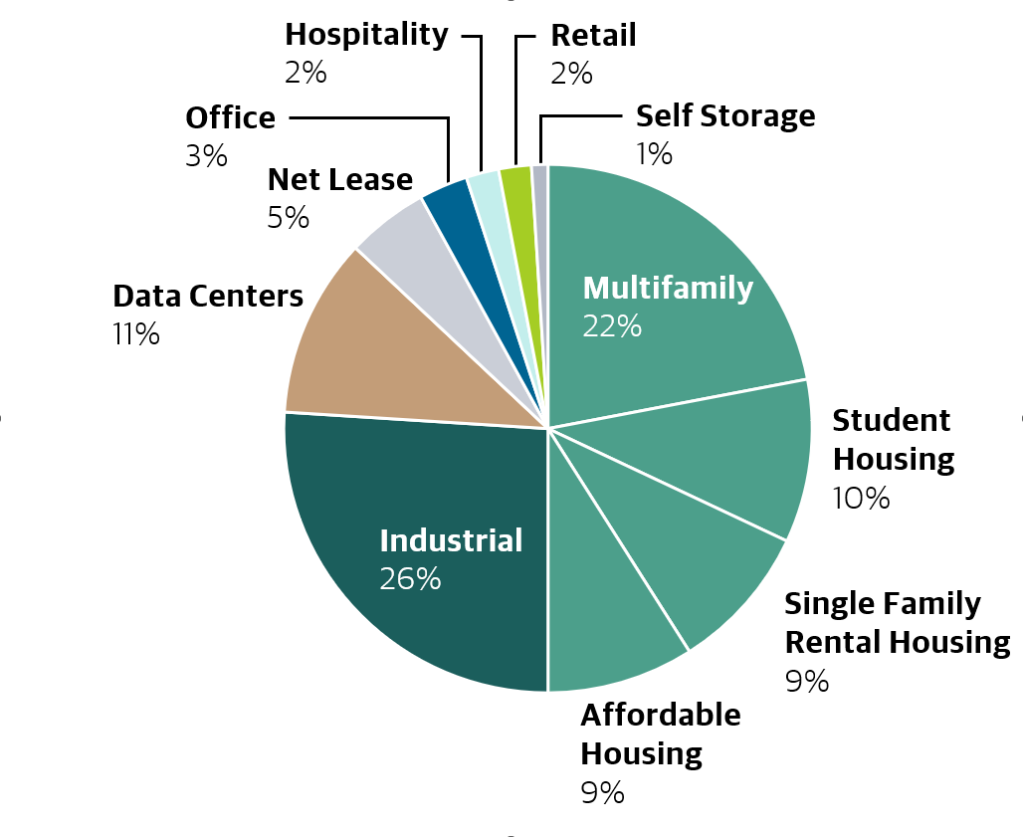

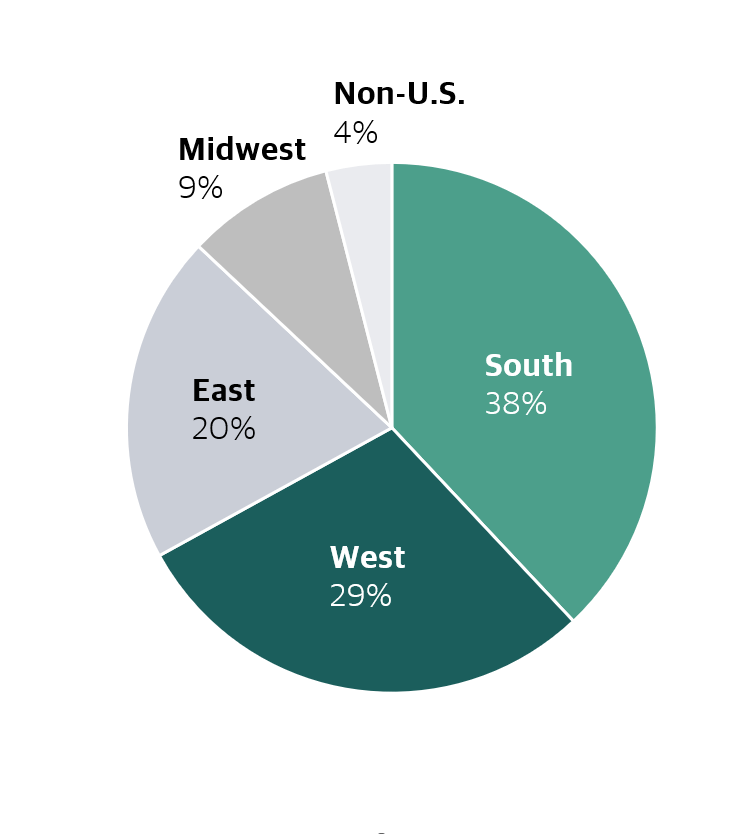

Why BREIT? BREIT continues to offer significant diversification benefits, low volatility and access to what we believe are Blackstone’s best ideas, including the fastest growing data center company in the U.S., the largest student housing company in the U.S. and the largest private owner of U.S. warehouses.13 Today, BREIT’s portfolio is 87% concentrated in rental housing, industrial and data centers, the sectors where we see the strongest potential for future growth. We are also ~70% concentrated in Sunbelt markets which are experiencing outsized growth, with Florida, Georgia and Texas as our largest states.3,14

Data centers represent BREIT’s fastest-growing real estate sector and our exposure is differentiated.15 Fundamentals in the sector are driven by unprecedented demand from AI, which we see as the ‘megatrend of megatrends’, as well as from the cloud and the digitization of the economy. Since 2021, when we acquired QTS, we have more than doubled our data center exposure from 4% to 11% and it has contributed ~450 basis points to performance in the last 12 months.16 While fundamentals have been incredibly strong in this sector, we believe there is still significant room for growth as the largest data center customers plan to invest over $1.5T in data infrastructure over the next five years.17 We are well positioned to capitalize on this surge in demand and have been growing QTS’s powered land each year, with $22B+ of construction in progress and $70B+ in additional future development potential.18,19

We also continue to have conviction in BREIT’s rental housing portfolio because of a structural undersupply of housing and near all-time high homeownership costs. Despite the population in the U.S. nearly doubling since 1960, annual housing starts have remained the same, resulting in a 4-5M home deficit.20 While rent growth has moderated in multifamily recently as new supply is absorbed, demand remains robust with national absorption at 2x the long-term average.21 Importantly, we are past peak supply in over 50% of BREIT’s markets and with new starts down ~40% we expect fundamentals to reaccelerate in the next 18 months.10,22 BREIT’s rental housing portfolio also benefits from diversification, with exposure to countercyclical subsectors like student housing where we are seeing high single-digit rent growth and affordable housing where growth also remains healthy.

Another tailwind for BREIT is continued demand for e-commerce, as we have gone from expecting 2-day delivery to 2-hour delivery which drives demand for last mile warehouses where BREIT’s industrial portfolio is focused. Cash flow in BREIT’s industrial portfolio remains strong, supported by embedded mark-to-market rent growth, with market rents 25% above BREIT’s in-place rents.23 Looking ahead, our industrial portfolio should benefit from increased pricing power, with new construction down 75%+ from its peak and limited exposure to coastal markets where the impact of increased supply has been the greatest.10

We designed BREIT nearly eight years ago to be a long-term core holding that produces consistent distributions with steady compounding and that is exactly what we have delivered. We constructed a portfolio that was consistently ahead of the curve by leveraging Blackstone’s proprietary insights from the world’s largest portfolio of commercial real estate and investing behind Blackstone’s highest conviction themes. Going forward, we believe this same investment approach will continue to power BREIT’s performance as the real estate recovery accelerates.

We are excited about the opportunities ahead and remain grateful for your confidence in BREIT.

Highlights from BREIT’s Q3 Stockholder Event

Hear the three key takeaways from our Q3 stockholder event featuring Jon Gray, Nadeem Meghji and Zaneta Koplewicz.

BREIT Highlights

9.8%

annualized net return for Class I since inception in January 20171

~50%

higher returns than publicly traded REITs since January 20172

87%

concentrated in rental housing, industrial and data centers3

Real Estate Values Have Bottomed in our Key Sectors and the Real Estate Recovery is Emerging

Green Street U.S. Commercial Property Price Index4

Lower Cost of Capital Can Be Highly Supportive of Real Estate Values

Interest Rates Falling After Historic Rate Hikes24

10-Year U.S. Treasury Yield

Power of Declining Cap Rates

- Lower interest rates typically lead to lower real estate cap rates (higher valuation multiples)

- While not directly correlated, the impact of lower interest rates on cap rates can be quite pronounced

Hypothetical Illustration12*

⭣10bps

decline in cap rates

⭡+4%

potential increase in returns

* The above example is for informational purposes only and there can be no assurance that actual results will be similar. Assumes no other changes to factors, positive or negative, influencing real estate values, including, without limitation, interest rates and net operating income. A change to any such factors could result in materially different performance.

Building Blocks for BREIT’s Outperformance

Capital markets improving

Real estate recovery underway

New supply declining

BREIT is concentrated in top sector and markets

Q3 2024 BREIT Highlights

** Rental Housing includes the following subsectors as a percent of real estate asset value: multifamily (22%, including senior housing, which accounts for <1%), student housing (10%), single family rental housing (9%, including manufactured housing, which accounts for 1%) and affordable housing (9%).

Key Portfolio Metrics

Performance Summary

Total Returns (% Net of Fees)1

| Share Class | Q3 2024 | Year to Date | Annualized 3-Year | Annualized Inception to Date | |

|---|---|---|---|---|---|

| Class I | 0.0% | 2.4% | 5.8% | 9.8% | |

| Class D | (No Sales Load) (With Sales Load)31 | -0.0% -1.5% | 2.2% 0.7% | 5.4% 4.9% | 9.6% 9.4% |

| Class S | (No Sales Load) (With Sales Load)31 | -0.2% -3.5% | 1.8% -1.7% | 4.9% 3.7% | 8.9% 8.4% |

| Class T | (No Sales Load) (With Sales Load)31 | -0.2% -3.5% | 1.8% -1.7% | 4.9% 3.7% | 9.1% 8.6% |

Annualized Distribution Rates32

4.7%

Class I

4.6%

Class D

3.9%

Class S

4.0%

Class T

Download BREIT’s Q3 2024 Update

Past performance does not predict future returns. Financial data is estimated and unaudited. All figures as of September 30, 2024 unless otherwise noted. Opinions expressed reflect the current opinions of BREIT as of the date appearing in the materials only and are based on BREIT’s opinions of the current market environment, which is subject to change. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

- Represents Class I shares. Please see above for additional performance periods for all BREIT share classes. Returns shown reflect the percent change in the NAV per share from the beginning of the applicable period, plus the amount of any distribution per share declared in the period. All returns shown assume reinvestment of distributions pursuant to BREIT’s distribution reinvestment plan, are derived from unaudited financial information, and are net of all BREIT expenses, including general and administrative expenses, transaction-related expenses, management fees, performance participation allocation, and share class-specific fees, but exclude the impact of early repurchase deductions on the repurchase of shares that have been outstanding for less than one year. The inception dates for the Class I, D, S and T shares are January 1, 2017, May 1, 2017, January 1, 2017 and June 1, 2017, respectively. Inception to date net returns for the other share classes: Class D shares (no sales load) 9.6%; Class D shares (with sales load) 9.4%; Class S shares (no sales load) 8.9%; Class S shares (with sales load) 8.4%; Class T shares (no sales load) 9.1%; Class T shares (with sales load) 8.6%. The returns have been prepared using unaudited data and valuations of the underlying investments in BREIT’s portfolio, which are estimates of fair value and form the basis for BREIT’s NAV. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated. As return information is calculated based on NAV, return information presented will be impacted should the assumptions on which NAV was determined prove to be incorrect. Past performance does not predict future returns. Inception to date (“ITD”) and 3-Year returns are annualized consistent with the IPA Practice Guideline 2018. Third quarter and year to date returns are not annualized.

- Publicly traded REITs reflect the MSCI U.S. REIT Index total return as of September 30, 2024. Private real estate reflects the NFI-ODCE preliminary net total return as of September 30, 2024. BREIT’s Class I inception date is January 1, 2017. During the period from January 1, 2017 to September 30, 2024, BREIT Class I’s annualized total net return of 9.8% was 46% higher than the MSCI U.S. REIT Index annualized total return of 6.8% and 2.8x the NFI-ODCE preliminary annualized total net return of 3.5%. BREIT does not trade on a national securities exchange, and therefore, is generally illiquid. The volatility and risk profile of the indices presented are likely to be materially different from that of BREIT including that BREIT’s fees and expenses may be higher and BREIT shares are significantly less liquid than publicly traded REITs. See “Important Disclosure Information–Index Definitions”.

- “Property Sector” weighting is measured as the asset value of real estate investments for each sector category divided by the asset value of all of BREIT’s real estate investments, excluding the value of any third-party interests in such real estate investments. Rental Housing includes the following subsectors as a percent of real estate asset value: multifamily (22%, including senior housing, which accounts for <1%), student housing (10%), single family rental housing (9%, including manufactured housing, which accounts for 1%) and affordable housing (9%).

- Green Street Advisors, as of September 30, 2024. Reflects the Commercial Property Price Index for All Property, which captures the prices at which U.S. commercial real estate transactions are currently being negotiated and contracted.

- National Council of Real Estate Investment Fiduciaries (“NCREIF”). Reflects the NFI-ODCE levered gross total return. Long-term average excluding 5-year recovery periods reflects annualized average 5-year returns from June 30, 1993 to June 30, 2024, excluding the 5 years following the Savings and Loan (“S&L”) Crisis (starting June 30, 1993) and Global Financial Crisis (“GFC”) (starting December 30, 2009). 5-year recovery periods post real estate (“RE”) downturns reflect the average of annualized 5-year returns following the Savings and Loan Crisis and the Global Financial Crisis. “See Important Disclosure Information—Index Definitions”.

- Bloomberg, NCREIF. Reflects annualized 3-year returns of the Bloomberg Aggregate Bond Index and the NFI-ODCE following three most recent 100bps+ declines in the 10-Year U.S. Treasury Yield where 3-year return data is available: February 2011 – August 2011, December 2013 – January 2015, November 2018 – December 2019.

- Declining borrowing costs reflects Blackstone Proprietary Data, as of September 30, 2024. Represents estimated senior financing rates for high-quality portfolio transactions. Base rate reflects 3-year SOFR swap rate (’23 wide as of October 18, 2023, and today as of September 25, 2024). Spread reflects weighted average spread across all rating tranches applied to estimated rating agency capital structures from each respective period. Increase in CMBS issuance reflects Green Street Advisors, as of September 30, 2024. Reflects U.S. single-asset, single-borrower (“SASB”) CMBS issuance volume.

- MSCI Real Capital Analytics, as of June 30, 2024. Reflects total U.S. transaction volume for transactions above $10M.

- Reflects equity deployed and committed by Blackstone Real Estate for the twelve-month period ended September 30, 2024.

- Refers to declines in new construction starts in the multifamily and industrial sectors. Multifamily reflects U.S. Census Bureau data and represents 39% decline in seasonally adjusted annualized rate of U.S. new privately owned multifamily starts from 2022 peak of the trailing three-month period ended November 30, 2022 to the trailing three-month period ended September 30, 2024. Privately owned multifamily starts are distinct from U.S. Census permits and completions figures and total housing starts (which include both single family and multifamily), which may differ in volume over a given period. As of September 30, 2024, the multifamily (including senior housing) and affordable housing sectors accounted for 22% and 9% of BREIT’s real estate asset value, respectively. Industrial reflects CoStar data and represents 77% decline in new industrial construction starts from the 2022 peak of Q3 2022 to Q3 2024. As of September 30, 2024, the industrial sector accounted for 26% of BREIT’s real estate asset value.

- Represents gross repurchase requests under BREIT’s Share Repurchase Plan.

- Assumes a stabilized, income-generating property with a 5% cap rate and 50% LTV. The hypothetical example is for information purposes only to illustrate potential impacts to private real estate returns. Assumes no other changes to factors, positive or negative, influencing real estate values, including, without limitation, interest rates and net operating income. A change to any such factors could result in materially different performance. Does not reflect the impact of all expenses, including potential fees. Conversely to the hypothetical illustration presented, a 10bps increase in cap rates (decrease in multiple) equates to a -4% potential decrease in real estate returns. There can be no assurance that the actual results will be similar to the example set forth herein. The potential impact of sustained lower interest rates on real estate cap rates is not directly correlated and may occur over time. This example does not constitute a forecast, and all assumptions herein are subject to uncertainties, changes and other risks, any of which may cause the relevant actual, financial and other results to be materially different from the results expressed or implied by the information presented herein. No assurance, representation or warranty is made by any person that the hypotheticals herein will be achieved, and no recipient of this example should rely on such hypotheticals.

- “Fastest growing” reflects Blackstone Proprietary Data and datacenterHawk as of March 31, 2024. Refers to growth in leased megawatts as of Q4 2019. Largest owner and manager reflects Student Housing Business data, as of December 31, 2023. Largest private owner of U.S. warehouses refers to Blackstone Real Estate’s U.S. warehouse portfolio, as of September 30, 2024.

- Sunbelt markets refer to the South and West regions of the U.S. as defined by NCREIF. The three states displayed accounted for 35% of BREIT’s real estate asset value. “Region Concentration” represents regions as defined by NCREIF and the weighting is measured as the asset value of real estate properties for each regional category divided by the asset value of all real estate properties, excluding the value of any third-party interests in such real estate properties. “Non-U.S.” reflects investments in Europe and Canada. Our portfolio is currently concentrated in certain industries and geographies, and, as a consequence, our aggregate return may be substantially affected by adverse economic or business conditions affecting that particular type of asset or geography.

- Fastest growing sector based on market rent growth.

- 4% concentration as of December 31, 2021. ~450bps refers to contribution to 1-Year BREIT Class I returns from the data centers, assuming no changes to any other factors impacting BREIT’s returns.

- Reflects cost estimate of $1.5T+ estimate reflects Dell’Oro Group report, as of July 2024. Investment expected over the next 5 years. There can be no assurance that the trends described herein will continue or not reverse.

- As of September 30, 2024. Reflects total cost for committed development projects at 100% ownership. As of September 30, 2024, BREIT’s ownership interest in QTS was 34% and the QTS investment accounted for 10.7% of BREIT’s real estate asset value. Reflects signed leases. There can be no assurance that these leases will commence on their current expected terms, or at all, and this information should not be considered an indication of future performance.

- As of September 30, 2024. Reflects cost estimate of developing data center projects on existing land bank acres and excludes committed development projects, at 100% ownership. This information is provided to illustrate the potential for additional development projects at QTS’s existing land bank acres, and there can be no assurance that any development projects will arise at these land bank acres. In addition, future land bank opportunities could be allocated to other Blackstone vehicles instead of to QTS or BREIT.

- As of June 30, 2024. Population growth refers to U.S. Bureau of Economic Analysis. U.S. multifamily construction starts refers to U.S. Census Bureau. 1960 refers to January 31, 1960. Home deficit refers to Blackstone Proprietary Data.

- RealPage Market Analytics. Reflects quarterly U.S. gross absorption in institutionally-managed multifamily properties tracked by RealPage. Long-term average refers to the ten years ended September 30, 2024. Today refers to September 30, 2024.

- RealPage Market Analytics. Reflects multifamily deliveries in BREIT’s U.S. multifamily markets.

- Blackstone Proprietary Data. Represents our estimate of the average embedded rent growth potential of BREIT’s industrial portfolio based on the difference between current in-place rents and current achievable market rents. See “Important Disclosure Information—Embedded Growth”. This is not a measure, or indicative, of overall portfolio performance or returns. Certain other BREIT property sectors have lower embedded rent growth potential. BREIT’s overall portfolio embedded growth potential was 12% as of September 30, 2024. BREIT’s industrial portfolio has a 3.6-year weighted average lease length. Reflects real estate properties only, including unconsolidated properties, and does not include real estate debt investments. For a complete list of BREIT’s real estate investments (excluding equity in public and private real estate-related companies), visit www.breit.com/properties. Embedded rent growth will not directly correlate with increased performance or returns and is presented for illustrative purposes only and does not constitute forecasts. There can be no assurance that any such results will actually be achieved. A number of factors, including operating expenses as described in BREIT’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 9, 2024, will impact BREIT’s net performance or returns. Any expectations that in-place rents have the potential to increase are based on certain assumptions that may not be correct and on certain variables that may change.

- U.S. Department of the Treasury. Reflects comparison between 4.28% on October 28, 2024 and the 2023 peak of 4.98% on October 19, 2023. There is no assurance that U.S. Treasury rates will continue to decline and changes in this measure may have a negative impact on our performance. A decline in interest rates has in the past caused, and may cause in the future, a reduction in the value of BREIT’s interest rate hedges and may adversely affect our performance.

- Total asset value is measured as (i) the asset value of real estate investments (based on fair value), excluding any third party interests in such real estate investments, plus (ii) the equity in our real estate debt investments measured at fair value (defined as the asset value of our real estate debt investments less the financing on such investments), but excluding any other assets (such as cash or any other cash equivalents). The total asset value would be higher if such amounts were included and the value of our real estate debt investments was not decreased by the financing on such investments.

- Number of properties reflects real estate investments only, including unconsolidated properties, and does not include real estate debt investments. Single family rental homes are not reflected in the number of properties.

- Occupancy is an important real estate metric because it measures the utilization of properties in the portfolio. Occupancy is weighted by the total value of all consolidated real estate properties, excluding our hospitality investments, and any third-party interests in such properties. For our industrial, net lease, data centers, office and retail investments, occupancy includes all leased square footage as of the date indicated. For our multifamily, student housing and affordable housing investments, occupancy is defined as the percentage of actual rent divided by gross potential rent (defined as actual rent for occupied units and market rent for vacant units) for the three months ended on the date indicated. For our single family rental housing investments, the occupancy rate includes occupied homes for the three months ended on the date indicated. For our self storage, manufactured housing and senior living investments, the occupancy rate includes occupied square footage, occupied sites and occupied units, respectively, as of the date indicated. The average occupancy rate for our hospitality investments was 73% for the 12 months ended June 30, 2024 and includes paid occupied rooms. Hospitality investments owned less than 12 months are excluded from the average occupancy rate calculation. Unconsolidated investments are excluded from occupancy rate calculations.

- Our leverage ratio is measured by dividing (i) consolidated property-level and entity-level debt net of cash and loan-related restricted cash, by (ii) the asset value of real estate investments (measured using the greater of fair market value and cost) plus the equity in our settled real estate debt investments. Indebtedness incurred (i) in connection with funding a deposit in advance of the closing of an investment or (ii) as other working capital advances will not be included as part of the calculation above. The leverage ratio would be higher if the indebtedness on our real estate debt investments and the pro rata share of debt within our unconsolidated investments were taken into account. The use of leverage involves a high degree of financial risk and may increase the exposure of the investments to adverse economic factors.

- Percentage fixed-rate financing is measured by dividing (i) the sum of our consolidated fixed-rate debt, secured financings on investments in real estate debt, and the outstanding notional principal amount of corporate and consolidated interest rate swaps, by (ii) total consolidated debt outstanding inclusive of secured financings on investments in real estate debt.

- Investment allocation is measured as the asset value of each investment category (real estate investments or real estate debt investments) divided by the total asset value of all investment categories, excluding the value of any third party interests in such assets. “Real estate investments” include wholly-owned property investments, BREIT’s share of property investments held through joint ventures and equity in public and private real estate related companies. “Real estate debt investments” include BREIT’s investments in commercial mortgage-backed securities, residential mortgage-backed securities, mortgage loans and other debt secured by real estate and real estate related assets, as described in BREIT’s prospectus. The Consolidated GAAP Balance Sheet included in our annual and interim financial statements reflects the loan collateral underlying certain of our real estate debt investments on a gross basis. These amounts are excluded from our real estate debt investments as they do not reflect our economic interest in such assets.

- Assumes payment of the full upfront sales charge at initial subscription (1.5% for Class D shares; 3.5% for Class S and Class T shares). The sales charge for Class D shares became effective May 1, 2018.

- Reflects the current month’s distribution annualized and divided by the prior month’s net asset value, which is inclusive of all fees and expenses. Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including, without limitation, borrowings, the sale of our assets, repayments of our real estate debt investments, return of capital or offering proceeds, and advances or the deferral of fees and expenses. We have no limits on the amounts we may fund from such sources. As of June 30, 2024, 100% of inception to date distributions were funded from cash flows from operations.

Important Disclosure Information

Blackstone Proprietary Data. Certain information and data provided herein is based on Blackstone proprietary knowledge and data. Portfolio companies may provide proprietary market data to Blackstone, including about local market supply and demand conditions, current market rents and operating expenses, capital expenditures, and valuations for multiple assets. Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and existing investments. While Blackstone currently believes that such information is reliable for purposes used herein, it is subject to change, and reflects Blackstone’s opinion as to whether the amount, nature and quality of the data is sufficient for the applicable conclusion, and no representations are made as to the accuracy or completeness thereof.

Embedded Growth. Embedded growth represents Blackstone’s expectations for growth based on its view of the current market environment taking into account rents that are currently below market rates and therefore have the potential to increase. These expectations are based on certain assumptions that may not be correct and on certain variables that may change, are presented for illustrative purposes only and do not constitute forecasts. There can be no assurance that any such results will actually be achieved.

Logos. The logos presented herein were not selected based on performance of the applicable company or sponsor to which they pertain. In Blackstone’s opinion, the logos selected were generally the most applicable examples of the given thesis, theme or trend discussed on the relevant slide(s). All rights to the trademarks and/or logos presented herein belong to their respective owners and Blackstone’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos.

Market Rent Growth. Overall year-over-year market rent growth in BREIT’s portfolio markets, weighted by BREIT’s real estate asset value in each sector, was 3% as of September 30, 2024. Multifamily (excluding senior housing) reflects Axiometrics data as of September 30, 2024 and represents -2% effective market rent change in BREIT’s markets weighted by unit count. Affordable housing reflects Blackstone Proprietary Data as of September 30, 2024 and represents 5% increase in maximum legal rents for 2024. Student housing reflects Blackstone Proprietary Data as of October 4, 2024 and represents 7% increase in rents for 2024-25 academic year compared to 2023-24 academic year based on 93% pre-leasing to date; assumes current asking rents are achieved for the remainder of the lease-up, of which there can be no assurance, and this information should not be considered an indication of future performance. Single family rental housing (excluding manufactured housing) reflects Blackstone Proprietary Data as of September 30, 2024 and represents -1% leasing spreads, comparing new or renewal rents to prior rents or expiring rents, as applicable. Manufactured housing reflects Blackstone Proprietary Data as of September 30, 2024 and represents 6% rent increases for renewal notices sent through September 30, 2024 for 100% of BREIT’s portfolio. There can be no assurance that such rents will actually be achieved, and this information should not be considered an indication of future performance. Senior housing reflects Blackstone Proprietary Data as of September 30, 2024 and represents 5% leasing spreads and compares new or renewal rents to prior rents or expiring rents. Industrial reflects Blackstone Proprietary Data as of September 30, 2024 and represents 1% market rent growth in BREIT’s U.S. industrial markets weighted by same property square footage at BREIT’s share. Net lease reflects Blackstone Proprietary Data as of June 30, 2024 and represents 1% year-over-year change in market rent based on estimated run-rate EBITDAR and market rent coverage ratio for BREIT properties. Data Centers reflect Wells Fargo estimate as of July 2024 and represents 17% estimated year-over-year U.S. data center rent growth for the full year 2024. There can be no assurance that such rents will actually be achieved, and this information should not be considered an indication of future performance. Self Storage reflects Blackstone Proprietary Data as of September 30, 2024 and represents -1% market rent change on new and renewal leases. Hospitality reflects Blackstone Proprietary Data as of September 30, 2024 and represents 1% year-over-year change in average daily rate (“ADR”). Retail reflects Blackstone Proprietary Data as of December 31, 2023 and represents estimated 7% market rent growth in BREIT’s markets. Office reflects Blackstone Proprietary Data as of September 30, 2024 and represents 0% market rent growth in BREIT’s markets.

Property Sector and Region Concentration. “Property Sector” weighting is measured as the asset value of real estate investments for each sector category divided by the asset value of all of BREIT’s real estate investments, excluding the value of any third-party interests in such real estate investments. Rental housing includes the following subsectors: multifamily (22%, including senior housing, which accounts for <1%), student housing (10%), single family rental housing (9%, including manufactured housing, which accounts for 1%) and affordable housing (9%). Please see the prospectus for more information on BREIT’s investments. “Region Concentration” represents regions as defined by the National Council of Real Estate Investment Fiduciaries (“NCREIF”) and the weighting is measured as the asset value of real estate properties for each regional category divided by the asset value of all of BREIT’s real estate properties, excluding the value of any third-party interests in such real estate properties. “Sunbelt” reflects the South and West regions of the U.S. as defined by NCREIF. “Non-U.S.” reflects investments in Europe and Canada. Our portfolio is currently concentrated in certain industries and geographies, and, as a consequence, our aggregate return may be substantially affected by adverse economic or business conditions affecting that particular type of asset or geography.

Third Party Information. Certain information contained in this material has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.

Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Select Images. The selected images of certain BREIT investments in this presentation are provided for illustrative purposes only, are not representative of all BREIT investments of a given property type and are not representative of BREIT’s entire portfolio. It should not be assumed that BREIT’s investment in the properties identified and discussed herein were or will be profitable. Please refer to www.breit.com/properties for a complete list of BREIT’s real estate investments (excluding equity in public and private real estate related companies), including BREIT’s ownership interest in such investments.

Index Definitions

An investment in BREIT is not a direct investment in real estate, and has material differences from a direct investment in real estate, including those related to fees and expenses, liquidity and tax treatment. BREIT’s share price is subject to less volatility because its per share NAV is based on the value of real estate assets it owns and is not subject to market pricing forces as are the prices of the asset classes represented by the indices presented. Although BREIT’s share price is subject to less volatility, BREIT shares are significantly less liquid than these asset classes, and are not immune to fluctuations. Private real estate is not traded on an exchange and will have less liquidity and price transparency. The value of private real estate may fluctuate and may be worth less than was initially paid for it.

The volatility and risk profile of the indices presented is likely to be materially different from that of BREIT including those related to fees and expenses, liquidity, safety, and tax features. In addition, the indices employ different investment guidelines and criteria than BREIT; as a result, the holdings in BREIT may differ significantly from the holdings of the securities that comprise the indices. The indices are not subject to fees or expenses, are meant to illustrate general market performance and it may not be possible to invest in the indices. The performance of the indices has not been selected to represent an appropriate benchmark to compare to BREIT’s performance, but rather is disclosed to allow for comparison of BREIT’s performance to that of well-known and widely recognized indices. A summary of the investment guidelines for the indices presented is available upon request. In the case of equity indices, performance of the indices reflects the reinvestment of dividends.

BREIT does not trade on a national securities exchange, and therefore, is generally illiquid. Your ability to redeem shares in BREIT through BREIT’s share repurchase plan may be limited, and fees associated with the sale of these products can be higher than other asset classes. In some cases, periodic distributions may be subsidized by borrowed funds and include a return of investor principal. This is in contrast to the distributions investors receive from large corporate stocks that trade on national exchanges, which are typically derived solely from earnings. Investors typically seek income from distributions over a period of years. Upon liquidation, return of capital may be more or less than the original investment depending on the value of assets.

An investment in BREIT differs from the MSCI U .S. REIT Index in that BREIT is not a publicly traded U.S. Equity REIT.

The MSCI U.S. REIT Index is a free float-adjusted market capitalization index that is comprised of equity REITs. The index is based on the MSCI USA Investable Market Index (IMI), its parent index, which captures large, mid and small cap securities. It represents about 99% of the U.S. REIT universe. The index is calculated with dividends reinvested on a daily basis.

The NFI-ODCE is a capitalization-weighted, gross of fees, time-weighted return index with an inception date of December 31, 1977. Published reports also contain equal-weighted and net of fees information. Open-end funds are generally defined as infinite-life vehicles consisting of multiple investors who have the ability to enter or exit the fund on a periodic basis, subject to contribution and/or redemption requests, thereby providing a degree of potential investment liquidity. The term diversified core equity typically reflects lower risk investment strategies utilizing low leverage and is generally represented by equity ownership positions in stable U.S. operating properties diversified across regions and property types. While funds used in the NFI-ODCE have characteristics that differ from BREIT (including differing management fees and leverage), BREIT’s management feels that the NFI-ODCE is an appropriate and accepted index for the purpose of evaluating the total returns of direct real estate funds. Comparisons shown are for illustrative purposes only and do not represent specific investments. Investors cannot invest in this index. BREIT has the ability to utilize higher leverage than is allowed for the funds in the NFI-ODCE, which could increase BREIT’s volatility relative to the index. Additionally, an investment in BREIT is subject to certain fees that are not contemplated in the NFI-ODCE.

Forward-Looking Statement Disclosure

This material contains forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, repurchases, acquisitions, future performance and statements regarding identified but not yet closed acquisitions or dispositions. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in BREIT’s prospectus and annual report for the most recent fiscal year, and any such updated factors included in BREIT’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or BREIT’s public filings). Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.